IC Markets Global

A Comprehensive Review of IC Markets: Unveiling the Pros and Cons

Introduction:

IC Markets has emerged as a prominent player in the online trading industry, gaining attention for its robust trading platform and competitive offerings. In this comprehensive review, we delve into the key aspects of IC Markets, exploring its strengths and weaknesses to provide potential traders with valuable insights.

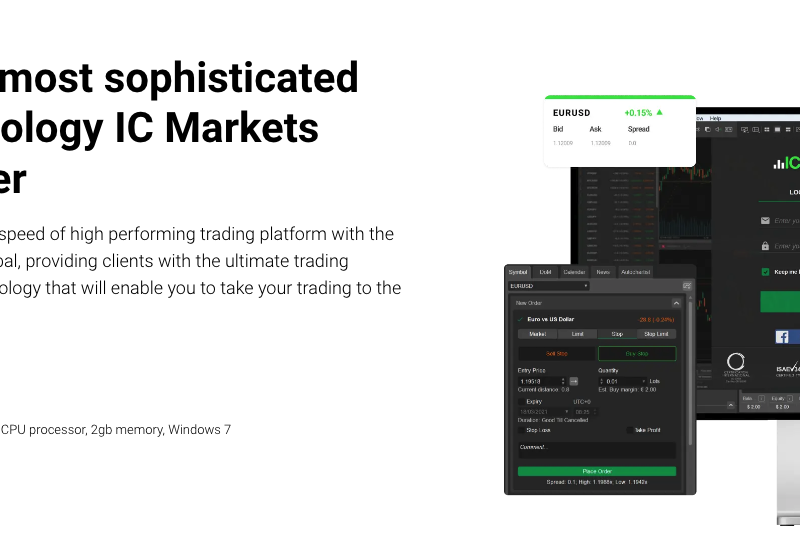

1. Trading Platforms: Cutting-Edge Technology

IC Markets impresses with its diverse range of trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. These platforms are known for their user-friendly interfaces, advanced charting tools, and seamless execution. Traders can access their accounts on desktop, web, and mobile devices, ensuring flexibility and convenience.

2. Asset Range: Extensive and Varied

One of IC Markets’ strengths lies in its extensive range of tradable assets. From Forex and commodities to indices and cryptocurrencies, the broker offers a diverse portfolio. This diversity allows traders to explore various markets and diversify their investment portfolios.

3. Competitive Spreads and Low Commissions: Cost-Efficient Trading

IC Markets stands out for its highly competitive spreads, making it an attractive option for cost-conscious traders. Additionally, the broker operates on a transparent commission-based model, eliminating potential conflicts of interest. This fee structure appeals to both novice and experienced traders seeking cost-effective trading solutions.

4. Execution Speed: Lightning-Fast Performance

Traders value speed, and IC Markets delivers with its impressive execution speed. The broker leverages advanced technology to ensure orders are filled promptly, minimizing slippage. This attribute is particularly crucial for those engaged in high-frequency trading strategies.

5. Regulation and Security: Trustworthy Operations

IC Markets is regulated by the Australian Securities and Investments Commission (ASIC), instilling confidence in traders regarding the broker’s compliance with industry standards. The adherence to stringent regulatory requirements contributes to a secure trading environment for clients.

6. Educational Resources: Room for Improvement

While IC Markets offers a range of educational materials, including webinars and tutorials, some users may find the resources relatively limited compared to other brokers. Enhancing the educational content could further empower traders, especially those new to the financial markets.

7. Customer Support: Responsive and Helpful

IC Markets prides itself on providing excellent customer support. The support team is available 24/7 and can be reached through various channels, including live chat and email. Traders commend the prompt and helpful responses, contributing to a positive overall trading experience.

8. Account Types: Catering to Diverse Needs

IC Markets offers various account types, such as Standard, Raw Spread, and cTrader, allowing traders to choose an account that aligns with their preferences and trading style. This flexibility is appreciated by a broad spectrum of traders, from beginners to seasoned professionals.

Conclusion:

In conclusion, IC Markets stands out as a reliable and competitive broker in the online trading landscape. With cutting-edge technology, diverse asset offerings, and cost-effective trading solutions, it caters to the needs of a wide range of traders. While there is room for improvement in educational resources, the overall package makes IC Markets a compelling choice for those seeking a trustworthy and efficient trading partner.