Acorns review

Introducing the limited edition Mighty Oak debit card

Introducing a new way of banking that saves and invests for you. Plus, earn more with two of the highest APYs available — 3.00% APY on Checking, 5.00% APY on Emergency Fund.

Invest spare change, invest while you bank, earn bonus investments, grow your knowledge and more.

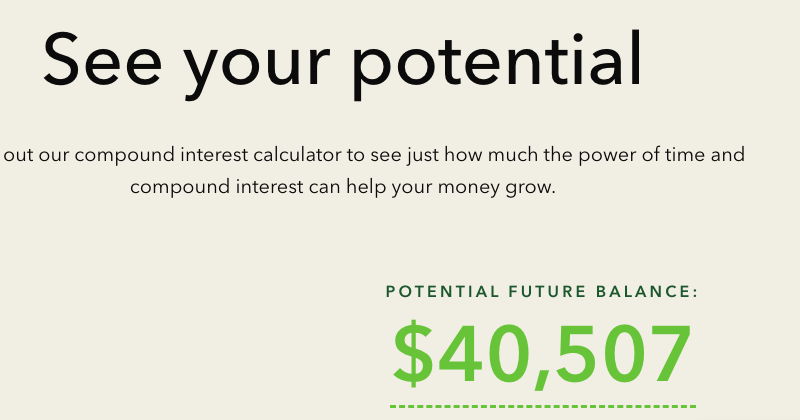

See your potential

Check out our compound interest calculator to see just how much the power of time and compound interest can help your money grow.

Automatically save and invest with Round-Ups® feature

Every purchase you make means an opportunity to invest your spare change! So coffee for $3.25 becomes a $0.75 investment in your future.

Expert-built portfolios, suggested for you

Acorns diversified portfolios are built by experts and include ETFs managed by pros at the world’s top investment firms like Vanguard and BlackRock.

Plus more ways to save, invest and learn

Along with your investment account, you get an easy, automated retirement account, banking that saves and invests for you, bonus investments when you shop with thousands of brands and unique ways to grow your knowledge.